One of the universal truths of commercial real estate is that the rent a property commands is closely tied to determining its value – far more so than with residential property. So, whether you’re planning to buy, sell or lease, examining data on the movement of asking prices for commercial rents is one of the most accurate ways to understand the property market – and therefore decide the best course of action.

Sure, listen to expert opinions; they are worth noting as any voice of experience is valuable. But the full, true picture will only become clear if these expert opinions can be sifted through a filter of solid data. Furthermore, such data needs to accurately gauge the entire market to be genuinely useful, as most published analysis and information about commercial property pertains solely to the highly visible “prime” real estate and ignores small to medium sized sectors. Often, this provides buyers, vendors and lessees who need it most with a distorted view of the overall market.

This widespread potential for misinformation was the impetus behind Australia’s leading independent website Commercial Property Guide’s developing the Asking Price Index. We believed there was a gap in the market for providing anyone seeking information in the commercial property sphere with the most balanced and accurate market picture possible. The Asking Price Index examines the small and medium size market each week to create an up-to-date and therefore most optimal indication of conditions as it tracks movement of rents across the board. The index is an excellent tool with which to gauge a commercial agents’ response to market conditions.

Here’s a glimpse at what’s happening—and why—in the Australian commercial real estate market from the perspective of asking price for rents as indicated in the most recent Commercial Property Guide Asking Price Index.

National Market Overview

The Australian market is made up of a relatively small number of significant markets. The three major markets of Melbourne, Sydney and Brisbane account for the lion’s share of the national commercial real estate industry.

These days there is no shortage of events influencing commercial real estate sentiment. Furthermore, not always do the three big metropolitan markets act in unison, mainly because they are reacting daily and in real-time to local events as well as those on a national and international scale.

Most recently, there were two full years between highs in commercial real estate, the national asking rent increases peaking in early 2017 and then trending down until this year in May when they started rising consistently. This upward movement is being driven by rising business confidence and limited commercial property supply in some leasing markets.

Major Markets

Sydney experienced several peaks and troughs in the past few years. These cycles have been about 10 to 14 months from peak to peak. While Sydney’s commercial real estate rent increases sailed through previous national elections unfazed, the past election was different: Sydney office rents dropped prior due to uncertainty surrounding the political landscape but have risen since the election was done and dusted. As Sydney commercial lease increases are driven by improving business confidence, Asking Price Index data shows rent rises reliably anticipating the business confidence survey a month ahead of the survey results being published.

Melbourne and Brisbane are not synchronised with Sydney. Melbourne rent increases were in a slow and graceful decline a few years ago. However, there has been an upswing in lease prices since the middle of 2018. In contrast, Brisbane rents have managed increases of only one per cent every three months at best. Business confidence in both Melbourne and especially Brisbane is lower than Sydney. Hence the lower commercial real estate lease increases outside of Sydney.

Office, Retail and Industrial

Office asking rent increases have been in what stockbrokers would call a “trading range” for many years, starting in January 2017 with a slow declining peak in each of the last three successive cycles. The Asking Price Index however shows signs of rents breaking out of the trading range.

This trend can be attributed to employment growth for office workers in the finance and service industries driving up rents for the limited supply of office space. Capital city fringe areas also have an excess of demand which is leading to rent increases.

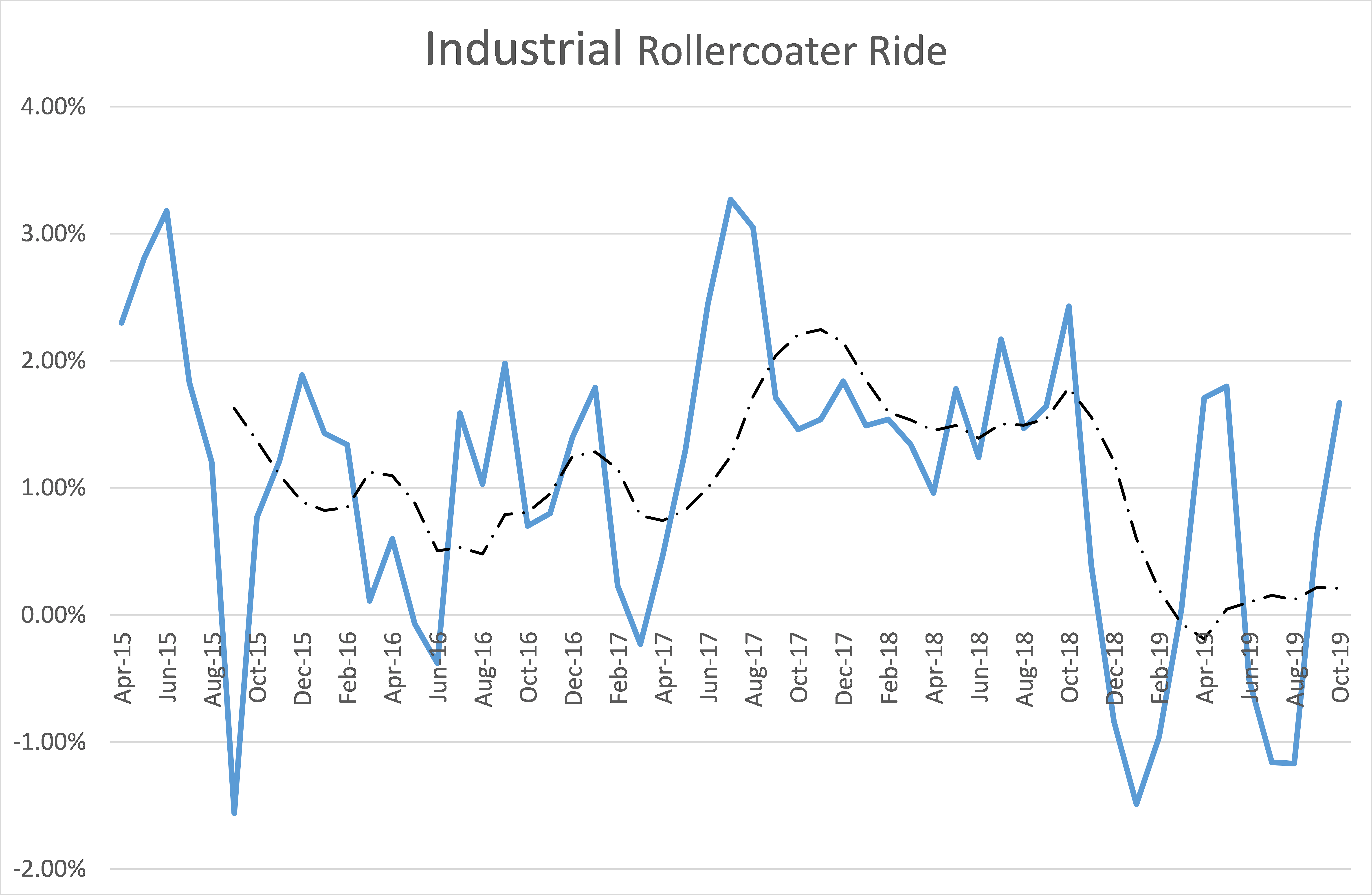

Retail rents present a far more interesting picture. The retail market was going down for quite some time, but, despite gloomy media forecasts, retail rents rose consistently from July 2018 until August 2019. However, the last couple of months have seen almost zero rent increases. By comparison, the industrial property market has travelled well for a good five years with reasonably stable rent growth, while industrial rents doing anything as they went on a rollercoaster ride of wild fluctuations particularly in the past 12 months.

Uncertainty in the outlook for both retail and industrial is triggering these patterns: retail confidence remains low and so do retail rent increases, while in the industrial sector confidence has continued to swing during the year. The uncertainty has further been triggered by a range of unique global and local factors that have caused rents to rise for some months only to be discounted as confidence evaporates.

Commercial real estate properties are valued on forecasts of future revenue they will generate. Changes in rent change not only affect a tenant’s hip pocket, but also the value of the landlord’s asset.

Using the week-by-week information contained in the Commercial Property Guide’s Asking Price Index is one of the most efficient ways to receive the up-to-date information required for timely, solid, unfiltered insights.

At the end of the day, data derived from accurate, comprehensive measurements is a critical and priceless tool to aid decisions that ultimately affect your future financial prosperity.