There is no denying rent is among the best indicators of a commercial property’s value – far more so than a residential property market. Commercial real estate generally (but not always) delivers lower capital growth but higher rental yields whereas housing does the reverse. Other economic factors will also impact commercial values, but as the trajectory of rents over time directly reflects demand, they will provide you with one of the most accurate pictures of the market whether your aim is to buy, sell or lease.

The problem is, most information published on commercial rent is based solely on fluctuations within prime real estate, instead of including those within the small and medium-sized sectors as well. This creates a distorted view of rental asking prices which impacts on the ability to make optimal decisions. Now with so many changes triggered by the pandemic, including a growing preference for workplaces in metro hubs over city CBDs, making sure you have the full picture is even more important.

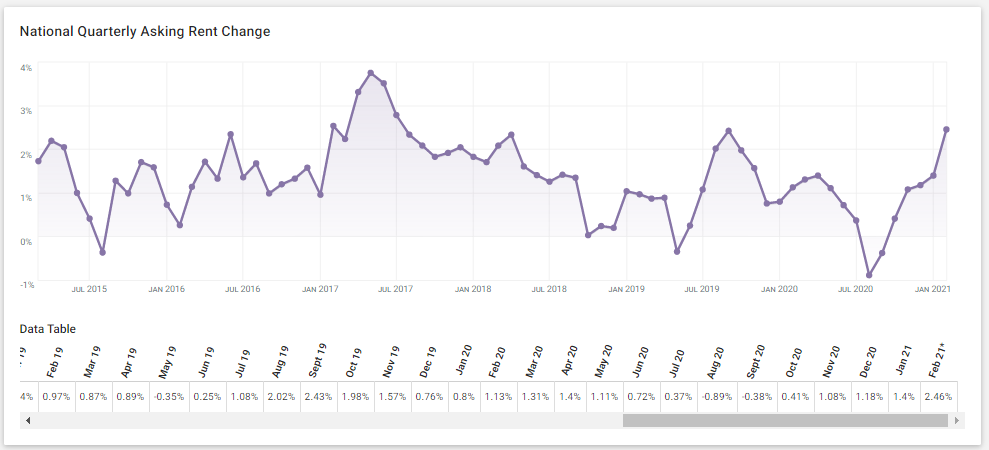

A clear market picture can only be captured from focussing on data across the board, and The Asking Price Index does exactly this. Our unique index tracks weekly rental movements which are displayed in three-month periods to create the most complete and up-to-date analysis available on commercial rents.

Current market conditions are reflected in our rental table. For instance, industrial rents are on the up in Sydney, driven by the logistics boom and demand for warehousing due to the increase in online shopping and home delivery. Melbourne’s office market is similarly looking up as tenant demand firms in places like inner-city Hawthorn as well as the suburban fringe, while Brisbane’s overall rental figures reflect a market recovering from a low base, the Sunshine State capital being one of the hardest hit over the previous 12 months.

Here is a glimpse into rental movements across different asset classes and capital cities derived from the latest Asking Price Index.

NATIONAL OVERVIEW

Three major markets account for the lion’s share of Australia’s commercial sector – Melbourne, Sydney and Brisbane - followed by Perth and Adelaide. As expected, all experienced downturn following March 2020’s COVID-driven lockdowns and restrictions. But hope reappeared within months and since July there has been a steady increase.

The national average now shows that there has been a consistent widespread rise of 2 per cent on quarter across Melbourne, Sydney and Brisbane.

Since the start of 2021 rental movements are rising faster than the corresponding pre-pandemic period last year.

Sydney

The rate of rent increases in this market has been declining since the mid-2017 boom, the exception being a spike following the 2019 election which was experienced across all capital city commercial markets.

After last year’s rollercoaster ride, asking rents in Sydney’s commercial market have been rising across all asset classes.

Brisbane

The Sunshine State capital’s commercial sectors were hit hardest of all by the pandemic. COVID sent rents plunging and kept them depressed far longer than other major markets. Thankfully moderate to strong recovery is occurring across all asset classes except industrial.

Melbourne

Commercial rents are increasing faster here than in Sydney. Following some of the longest and most restrictive periods of lockdown, the Asking Price Index is showing asking rents in Melbourne rising about 2 per cent per quarter.

|

|

|

|

|

| |

Industrial

|

Retail

|

Office

|

|

Adelaide

|

$152

|

$315

|

$376

|

|

Brisbane

|

$149

|

$335

|

$282

|

|

Melbourne

|

$169

|

$433

|

$493

|

|

Perth

|

$157

|

$274

|

$246

|

|

Sydney

|

$235

|

$508

|

$516

|

Capital City Asking Rents per Sqm in May 2021

RETAIL

All 5 major capital city markets are experiencing growth in retail rents. Brisbane and Adelaide are leading the charge with the most rapid rises since September 2020, asking rents shooting up just over 4 per cent in Brisbane and just under this level in Adelaide.

Sydney, Melbourne and Perth are showing a more modest pattern, with increases in this time period of between .5 to 1 per cent.

Leasing incentives granted to keep embattled retailers from closing their doors and leaving premises vacant is partially behind the lower rate of increases according to industry observers. Ben Tremellen, partner at national leasing specialists Retail Realm, said tenants in Melbourne’s Bourke Street Mall precinct recently received breaks on rent of around 20 per cent while those on the Swanston Street strip were given as much as 30 per cent. “The market reacted quickly to keep people trading,” Mr Tremellen said.

INDUSTRIAL

All 5 major markets are trending up except in Brisbane. Asking rents demanded by the city’s industrial properties have nosedived almost 3 per cent in as many months.

Adelaide is also showing a steep recovery with rental increases of around 2 per cent. Vacancies across industrial have tightened as business owners take advantage of low interest rates which have made it more cost effective to invest in their premises rather than rent. Industrial assets have also risen in popularity due to the pandemic-driven surge in e-commerce and need for logistics warehousing.

OFFICE

This sector is experiencing one of the strongest recoveries of all asset classes in every capital city as companies continue to push for workers to return to the office, not only to boost their own productivity but that of the national economy. The asset class has further been boosted by the fact more companies are setting up offices in suburban hubs rather than prime CBD office towers, a trend the Asking Price Index will detects due to the fact it tracks across entire metro areas, not only city centres.

Sydney and Melbourne traditionally see the greatest swings in office rents. In the last three months however, metro Sydney’s, Melbourne and Adelaide asking rents for offices have shot up around 3 per cent followed by Perth and Brisbane with an average 1 per cent rise.